Illinois Investment Financing

Blogs

The brand new Silver were only available in 2019 by the Kirill Bensenoff and Alex Shvayetsky. They supply multiple individual money financial loans such as boost and you may flip, local rental, soil up-and signature loans. Lima You to Financing would depend in the Greenville, South carolina and you may based by previous Marines.

Multi-Loved ones Finance

Joshua Holt are a licensed home loan founder (NMLS # ) and you can creator from Biglaw Investor. Their financial possibilities is based on other areas out of professional mortgages, especially for lawyers, doctors or any other higher-money advantages. Prior to Biglaw Trader, Josh practiced personal equity mergers & acquisition laws for one of your biggest law offices on the nation. Simple Road Investment’s EasyFix loan program will bring develop and you can flip finance to have people to buy attributes. The rental funding fund try versatile and versatile, giving you the brand new control you desire and also the reliable funding you wanted. The flexible FixNFlip finance clarify the new acceptance procedure and permit your to go rapidly, optimize your power, and you can pivot when needed.

- This means they could render more customized mortgage terminology in order to meet the new borrower’s book requires.

- After you have a summary of potential loan providers, take the time to examine their terminology, rates, and costs to be sure you’ll receive a knowledgeable bargain it is possible to.

- Find the strength out of private credit to have Illinois a home investment with Lima One to Investment.

- While the their inception in 2011, Lima One to Funding has financed more $9 billion in the money the real deal home people who are strengthening, improving, and stabilizing communities nationally.

Boost And you can Flip Money

The newest recent event is not the first-time those funds features dropped out of a relocation truck recently. Nevertheless signed up to hand the newest secrets to Busey as opposed to try to re-finance the structure inside a shorter friendly rate of interest environment compared to the whether it borrowed. Clear Top, which possess more than 100 industrial and you can commercial features from the Midwest, gotten the new Pine Brook business building to own $13 vogueplay.com their explanation million inside the 2018 included in a jv that have trader Ryan Corcoran. The purchase price is actually a bargain at the time, while the assets fetched more than $20 million within the 2001, DuPage State information tell you. Panko’s purchase try funded which have a $ten.5 million financing out of Lakeside Financial, public records let you know. It might resulted in inclusion out of retail to your a portion of the house as he considers redeveloping a slice one to’s extremely visible, considering a news release.

Chicago and you will Washington, D.C., Among Urban centers Perfect for Work environment-to-Co-Life Sales

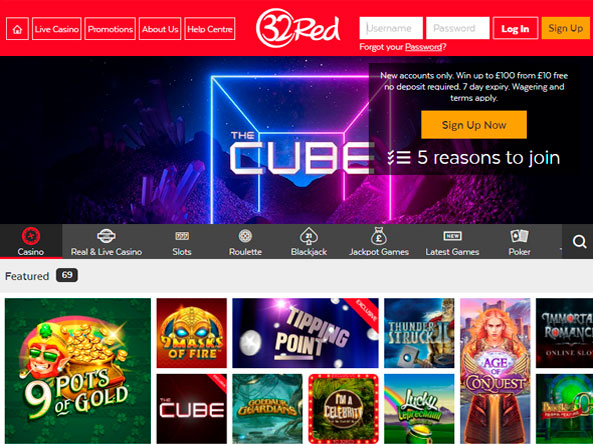

The brand new MGM subsidiary brings various online casino games that have harbors and on line desk games on the industry’s greatest app developers. Real-money casinos on the internet give you the industry’s greatest casino games to help you qualified players in the legal states. Best real money casinos were common brands for example BetMGM, the fresh Caesars Castle On-line casino, DraftKings, and FanDuel. The dimensions and you may development of the newest Chicago local rental possessions industry try encouraging for people.

They supply short-term enhance and you can flip money and investment property fund. Closure as fast as 5 working days, at the mercy of obvious label. Individual lending money dedicated to individuals loan types, as well as connection finance, boost and you will flip financing, ground-upwards fund, and you can refinance financing.While we are investment-centered … NuWay Home loan try personal money-lender located in Chicago, IL. They provide short-term bridge financing, refinancing, and short-term improve and flip financing. Clarence finds out property from the Lake North subdivision out of Chicago, IL so you can upgrade and you may resell.

If you are considering a difficult currency loan inside Chicago, it is important to do your research and find a reliable financial. One method to see an established difficult money lender is to ask for advice from other a house investors on the community. You can even search on the internet for tough currency loan providers inside Chicago and read analysis away from prior clients. A hard money loan could possibly offer consumers plenty of benefits. Filled with delivering entry to the brand new financing they require when almost every other lenders have turned into her or him off. This type of fund normally are available easily, too, which means that individuals can buy a property within the a primary amount of time.

Nether I, nor any of my family could have got currency to own a visit in this way once they in which inside college or university. When he returned the guy become college or university in the Columbia University within the Ny. It is today the guy wants people to-name him Barack — maybe not Barry. Just after Columbia, the guy went to Chicago to work as the a residential area Organizer to have $12,100 a year.

Complete Illinois Industry Trend

EquityMax registered the newest flex, offering a “zero assessment” choice to make sure the brief closing the brand new debtor is actually requesting. From the EquityMax, we feel inside which have the customers talk individually to the employers. Our company is children owned-and-manage bank your finance. The owners of your team will be the final decision producers and you can are content to talk personally along with you regarding the form of financing requires on each and every real estate investment endeavor.

Unlike traditional loans from banks or borrowing from the bank unions, hard money finance are typically provided by private someone or businesses. These fund are protected because of the a home and therefore are often put by the borrowers whom may not be eligible for traditional investment due to things such poor credit or strange assets brands. Difficult currency money typically have higher rates and you will reduced cost terms than the antique finance, nonetheless they provide immediate access to money for real house investment or any other economic requires. Full, difficult money financing are a valuable investment for real estate traders and you may money spent residents inside Chicago who require fast access to help you investment and you will appreciate the flexibility away from difficult money fund. When compared to antique financial institutions, hard currency loan providers provide a great speedier application processes, reduced stringent requirements, and you may monetary alternatives tailored to the needs away from local people. Tough currency loan providers Chicago provide a new option to a home traders and property owners seeking to make use of financing opportunities.